Stealthy arithmetic

Table of Contents

Table of Contents

Are you struggling to make ends meet? Do you find yourself living paycheck to paycheck? One way to take control of your finances is by drawing up a budget for your household. Learning how to draw up a budget for a household can be a game-changer when it comes to managing your money and achieving your financial goals.

Pain Points

When it comes to managing finances, many people find it overwhelming and don’t know where to start. They may be unsure of how to track their expenses, worried about not having enough money to cover their bills, or simply do not know how to create a budget. It can be challenging to break old spending habits, and many people are worried about how to make lifestyle changes to become more financially responsible.

Answer To How To Draw Up A Budget For A Household

Learning how to draw up a budget for a household may seem intimidating at first, but with a little bit of effort and patience, anyone can do it. A budget is simply a financial plan that helps you manage your spending and keep track of your income. By creating a budget, you can prioritize your expenses and ensure that you are living within your means. A budget can also help you save money, pay off debt, and achieve your financial goals.

Main Points

The key to creating a budget is to start by understanding your current financial situation. Begin by creating a list of all your income and expenses. Next, prioritize your expenses by setting goals for saving and spending. Be realistic about your spending habits, and try to make small changes to cut back on unnecessary expenses. Lastly, track your spending and adjust your budget accordingly.

Start With Small Goals

One of the best ways to start your budget journey is by setting small goals. Start by tracking your expenses for a month and identifying areas where you can cut back. Perhaps you are eating out too often or buying too many clothes. Once you have identified these areas, create a plan to reduce your spending gradually. Focus on one expense at a time, and be patient with yourself. Remember, creating a budget is a process, and it takes time to see results.

The Importance Of Accountability

Accountability is an essential part of sticking to your budget. Find a friend, family member, or financial advisor who can hold you accountable for your spending. Consider using budgeting apps or software to keep track of your spending automatically. Celebrate your progress and achievements along the way, and don’t be too hard on yourself when mistakes happen.

Monitor Your Progress

It’s essential to monitor your progress towards your financial goals regularly. Review your budget every month, and adjust your goals as necessary. Use your achievements as motivation to keep going and celebrate your successes. Build on your progress by setting new goals and striving towards a more financially stable future.

Question and Answer

Q:

What are some tips for sticking to a budget?

A:

Set realistic goals, be patient with yourself, and track your spending consistently. Stay accountable and find tools or resources that can help you stick to your budget, such as budgeting apps and financial advisors.

Q:

How often should I review my budget?

A:

You should review your budget every month and adjust your goals as necessary. It’s also helpful to review your budget before making any significant purchases to ensure they fit within your financial plan.

Q:

How can I reduce my monthly expenses?

A:

Identify areas where you can cut back, such as eating out less, canceling unused subscriptions, and reducing your energy usage. Shop around for better rates on bills, such as insurance or internet, and try to negotiate a lower rate on regular expenses.

Q:

What do I do if I overspend within my budget?

A:

Don’t panic! Review your budget, identify where you overspent, and adjust accordingly. Consider cutting back on discretionary spending for the following month and focusing on your essential expenses.

Conclusion Of How To Draw Up A Budget For A Household

Drawing up a budget for your household can be an effective way to control your finances and achieve your financial goals. Remember that creating a budget is a process, and it requires patience, consistency, and accountability. Start small, set achievable goals, and track your progress to build towards a more financially stable future.

Gallery

How To Create A Household Budget | Household Budget, Budgeting, Household

Photo Credit by: bing.com /

Stealthy Wealth: How To Draw Up A Budget

Photo Credit by: bing.com / stealthy arithmetic

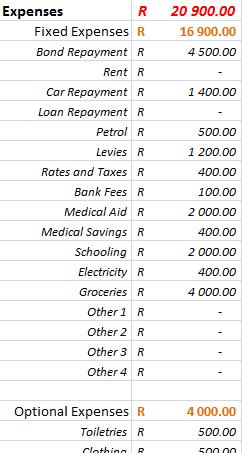

Here’s An Example Of How I List My Expenses As I Draw Up A Budget:

Photo Credit by: bing.com /

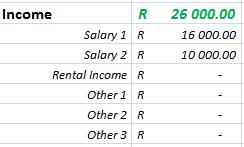

How To Draw Up A Budget | City Press

Photo Credit by: bing.com / budget draw city expenses

Stealthy Wealth: How To Draw Up A Budget

Photo Credit by: bing.com / wealth stealthy income